[GA] How do I file taxes for an LLC that became an S-corp?

You generally don’t need to update your Georgia LLC Operating Agreement when electing S-Corp tax status, because the tax election doesn’t change the LLC’s legal structure. However, it’s a good idea to review and possibly amend the Operating Agreement to reflect the S-Corp election for clarity and to ensure compliance with IRS requirements.

- Why you might not need to update: The Operating Agreement governs the LLC under state law (ownership, management, operations). Electing S-Corp status affects federal tax treatment only, not the LLC’s legal form, so core provisions usually remain valid.

- When you should consider updating: If your Operating Agreement contains provisions that conflict with S-Corp requirements (for example, multiple classes of stock or non-proportional profit distributions), you should amend it. S-Corps require a single class of stock and distributions proportional to ownership. Adding a note that the LLC is taxed as an S-Corp can also help for future clarity.

- Practical steps:

• Review the existing Operating Agreement for conflicts with S-Corp rules.

• Consult a tax professional or attorney familiar with Georgia LLCs and S-Corp rules.

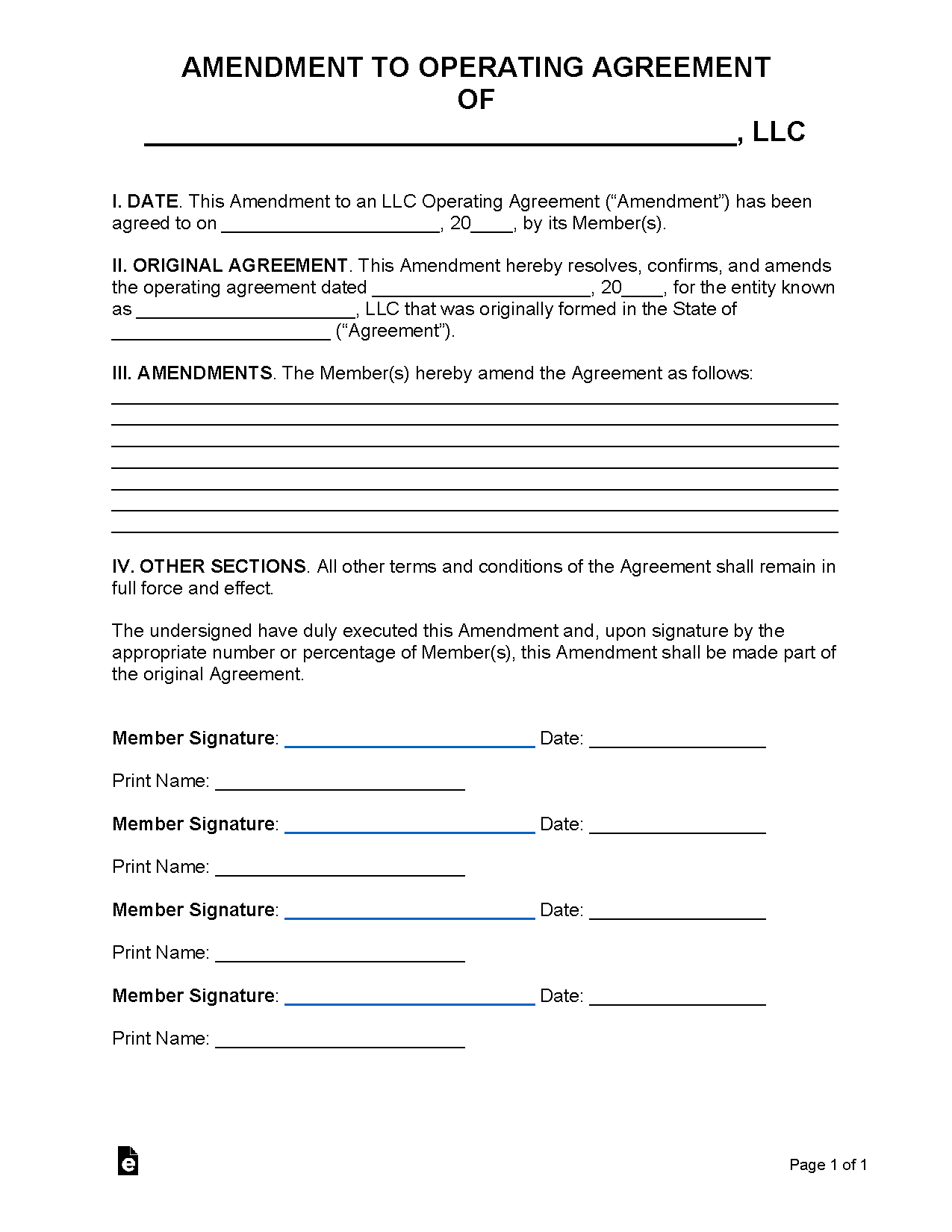

• If needed, draft and sign an amendment that notes the S-Corp election and any compliance changes; keep it with your LLC records.

• Maintain S-Corp compliance (file Form 1120S annually, pay yourself a reasonable salary if active, keep proper records). - The S-Corp election is made with IRS Form 2553. For Operating Agreement amendments, you can use generic LLC amendment templates, but you’ll likely need to customize them for S-Corp specifics.

- Next steps for you: Confirm Form 2553 was properly filed and accepted. If not filed, you may need to seek late election relief (IRS guidance). Review your tax filings to ensure they reflect S-Corp status. Review and amend the Operating Agreement only if necessary for compliance or clarity.

Full Conversation

What form do I use for a Georgia single-member LLC that later chose to be taxed as an S-Corp (formerly taxed as a disregarded entity)?

I understand your situation. Have you already formed the Georgia SMLLC and now want to elect S-Corp tax status for it?

No — this was all done in 2022. Just playing catch up with paperwork.

Are you looking for specific guidance on how to file the election for S-Corp tax status with the IRS?

No.

Is there anything else the lawyer should know before I connect you?

Do we have to update the operating agreement if we are being taxed as an S-Corp now?

Hello — welcome and thank you for your question. I’m reviewing this now.

Thanks.

You generally don’t need to update your Georgia LLC Operating Agreement when electing S-Corp tax status, because the tax election doesn’t change the LLC’s legal structure. However, it’s a good idea to review and possibly amend the Operating Agreement to reflect the S-Corp election for clarity and to ensure compliance with IRS requirements.

- Why you might not need to update: The Operating Agreement governs the LLC under state law (ownership, management, operations). Electing S-Corp status affects federal tax treatment only, not the LLC’s legal form, so core provisions usually remain valid.

- When you should consider updating: If your Operating Agreement contains provisions that conflict with S-Corp requirements (for example, multiple classes of stock or non-proportional profit distributions), you should amend it. S-Corps require a single class of stock and distributions proportional to ownership. Adding a note that the LLC is taxed as an S-Corp can also help for future clarity.

- Practical steps:

• Review the existing Operating Agreement for conflicts with S-Corp rules.

• Consult a tax professional or attorney familiar with Georgia LLCs and S-Corp rules.

• If needed, draft and sign an amendment that notes the S-Corp election and any compliance changes; keep it with your LLC records.

• Maintain S-Corp compliance (file Form 1120S annually, pay yourself a reasonable salary if active, keep proper records). - The S-Corp election is made with IRS Form 2553. For Operating Agreement amendments, you can use generic LLC amendment templates, but you’ll likely need to customize them for S-Corp specifics.

- Next steps for you: Confirm Form 2553 was properly filed and accepted. If not filed, you may need to seek late election relief (IRS guidance). Review your tax filings to ensure they reflect S-Corp status. Review and amend the Operating Agreement only if necessary for compliance or clarity.

It sure does. Thank you so much, Joel!

You’re welcome — happy to help. If you have follow-ups, reach out. If this helped, I’d appreciate a positive review.

I would be happy to give you a positive review.